Special Report

Nuclear Revival: A Resurgence for Uranium Miners

Bullish on Uranium: Why the Case Remains Strong

Physical uranium was one of the strongest-performing assets in 2023, returning nearly 90%. The start of 2024 had been no different as uranium prices continued to climb, increasing to $106 per pound in late January.1 However, after reaching that height, uranium prices corrected and have been range bound between $85 to $90 per pound. At this writing, uranium was priced at $87.90 per pound (April 24, 2024). In our view, this correction was not unexpected due to uranium’s rapid rise in 2023.

Given the recent pullback, investors may wonder if there is still room to run in this uranium bull market.

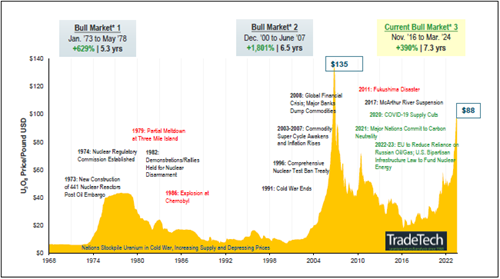

We believe so. Although the price of uranium has appreciated significantly, we’re still well shy of the record $135 per pound realized in 2007, or $200 per pound when adjusted for inflation, as shown in Figure 1.2 Rising global commitments to nuclear energy and other supporting factors are helping to make uranium a more compelling investment than ever.

Figure 1. The Uranium Bull Market Is Underway, Potentially with Room to Run (1968-3/31/2024)

Source: Data as of 03/31/2024. TradeTech is the leading independent provider of information on uranium prices and the nuclear fuel market. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/. Note: A “bull market” is when financial market prices are generally rising. A “bear market” refers to a condition when financial market prices are generally falling.

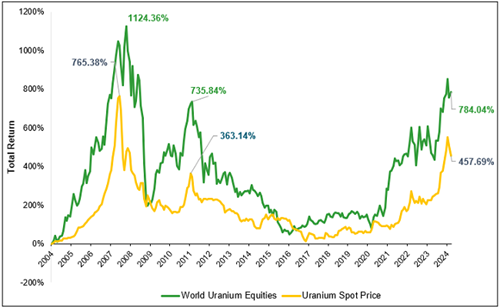

The Uranium Miners Opportunity

When physical uranium is in play, the uranium miners behind the scenes provide a crucial element of support. There is no uranium without mining, and we believe miners will continue to provide a strong foundation for the continued growth of uranium markets. In 2023, spot uranium climbed 88.54%3 while uranium miners posted gains of 58.47%.4 Thus far in 2024, uranium miners are up 2.56% year-to-date through March 31, and spot uranium is off 3.26%. As seen in Figure 2, uranium miners have historically outperformed the underlying metal during bull markets, including the current one.

Figure 2. Uranium Equities Have Outperformed During Uranium Bull Markets (2004-2024)

Source: Bloomberg and TradeTech LLC. Data from 1/30/2004 to 03/31/2024 reflect the longest available data. World Uranium Equities is measured by the URAX Index, which tracks the performance of stocks globally that conduct business with uranium. URAX and Uranium Spot are denominated in U.S. dollars. You cannot invest directly in an index. Past performance is no guarantee of future results.

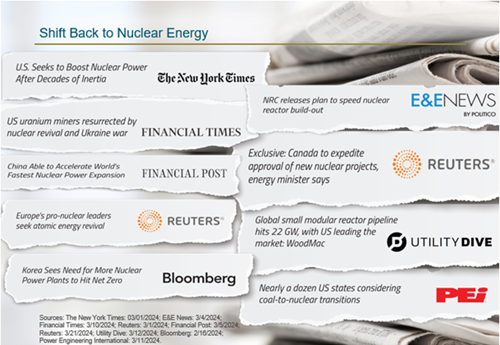

Governments Are Increasingly Embracing Nuclear Energy

The news at the end of 2023 propelled uranium to fresh 16-year highs, which included an agreement reached at December’s COP28 (United Nations Climate Change Conference) meeting by 22 nations to triple their nuclear capacity by 2050. In early January, the UK government announced its intent to make faster investment decisions on new nuclear projects, on its way to quadrupling capacity by 2050.5 Achieving this goal would increase the share of Britain's forecasted electricity demand met by nuclear energy from 15% to 25%.6 All told, there are 152 nuclear reactors either under construction or planned for construction around the globe, representing an increase of about 35% in global nuclear reactors.7

Figure 3.

Digging out of the “Lost Decade”

Concurrently, we’re coming out of a lost decade for uranium mining. The price of uranium dropped from about $140 a pound in 2007 to less than $20 per pound in 2016. This coincided with a prolonged period of underinvestment in the sector following the Fukushima nuclear accident in 2011, and as mines were placed on care and maintenance. Utilities were able to use existing uranium stockpiles to meet energy generation needs as higher-cost mines went dormant. Those stockpiles have largely been depleted, and utilities find themselves needing to enter into offtake agreements to purchase future mine production years in advance.

New Energy Demand from Artificial Intelligence (AI)

Since going live with ChatGPT in November 2022, the field of Artificial Intelligence has experienced explosive growth. AI promises to automate tasks across many industries and support economic development comparable to the Industrial Revolution of (1820-1840 in the U.S.). AI data centers will likely require massive amounts of reliable, low-carbon energy like that produced by nuclear power. Technology firms and AI startups have been openly supporting the development of nuclear power, with an eye toward supporting SMR (small nuclear reactors) development. It has been estimated, given current growth, that some new AI servers could require 85 terawatt hours of electricity per year, which equates to “more than some small nations’ annual energy consumption” of electricity each year, researchers have estimated — which is more than some small nations’ annual energy consumption.8 To understand how AI is transforming industries, in Figure 4 we show the 2023 revenues of NVIDIA’s (a leading U.S. provider of AI solutions) four largest markets.9

Figure 4. NVIDIA’s Fiscal 2023 Market Platforms

Source: 2023 NVIDIA Corporation Annual Review.

Uranium Demand Expected to Continue Rising

Contracts signed by utilities for uranium topped 160 million pounds in 2023, making it the highest annual volume in over a decade.10 The climbing prices have bolstered mining companies’ stock prices. Demand for uranium is expected to increase nearly 30 percent by 2030, and double by 2040.11 As much of the world begins to steer away from reliance on Russia for refined uranium supply, focus will turn to miners in other areas as increased and, in our view, renewed production will be both expected and necessary.

Uranium Miners Are Working to Meet Production Challenges

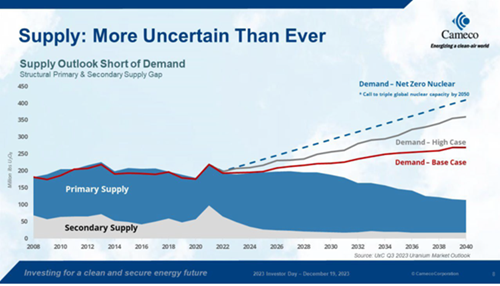

Now that uranium prices have returned to more profitable levels, many previously closed mines are taking steps to start producing again. However, adding to the supply of uranium isn’t as simple as flipping a switch, and increasing uranium production is proving difficult. Cameco, the largest uranium mining company by market cap, had to lower its production forecast in 2023 at its Cigar Lake Mine and its McArthur River/Key Lake operations, expecting a nearly 3-million-pound shortfall.12 Kazatomprom, which produces about 44% of the world’s uranium, announced in February that it will fall short of production targets in 2024 and likely in 2025.13

The under investment in the sector and long lead times to develop complex mines are clearly taking their toll and are likely to slow the supply response. At its December Investor Day, Cameco released its uranium supply estimates through 2040. Figure 4 illustrates a potential shortfall of uranium to meet utility requirements, which may lead to a cumulative deficit of 2.3 billion pounds by 2040.

Figure 5.

Source: Cameco. Data as of December 2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Is the Moment Yet to Come for Uranium Miners?

We believe a growing uranium mining sector will attract additional and even larger investments drawn by the prospects of attractive investment returns. Is there still room to run in this uranium bull market? We believe so, and uranium miners, with scarce representation in major market indexes, can add growth potential and diversification to investor portfolios.

Footnotes

| 1 | Bloomberg as of January 19, 2024. |

| 2 | TradeTech and Bloomberg as of December 31, 2023. |

| 3 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 4 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 5 | Reuters, “UK to Invest Extra $1.7 Billion in Sizewell C Nuclear Power Station,” January 22, 2024. |

| 6 | Reuters, “Britain Aims for Faster Investment Decisions on New Nuclear Projects,” January 11, 2024. |

| 7 | World Nuclear Association as of April 23, 2024. |

| 8 | Scientific American, The AI Boom Could Use a Shocking Amount of Electricity, October 13, 2024. |

| 9 | 2023 NVIDIA Corporation Annual Review. |

| 10 | Yahoo Finance, Uranium's "Third Bull Market" Set to Shine in 2024. |

| 11 | Reuters, Demand for uranium for reactors seen jumping 28% by 2030. |

| 12 | Cameco, Press Release, September 3, 2023. |

| 13 | Kazatomprom, “Kazatomprom 4Q23 Operations and Trading Update” February 1, 2024. |

Important Disclosure

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and statements are unique and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this content are those of the presenter and may vary widely from opinions of other Sprott affiliated Portfolio Managers or investment professionals.

While Sprott believes the use of any forward-looking language (e.g, expect, anticipate, continue, estimate, may, will, project, should, believe, plans, intends, and similar expressions) to be reasonable in the context above, the language should not be construed to guarantee future results, performance, or investment outcomes.

This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott.com.

The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering or tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on specific circumstances before taking any action.

© Sprott 2024