Sprott Inc. (NYSE/TSX: SII)

Environmental, Social and Governance ("ESG")

Related Links

Sprott Inc. is committed to the highest standards in sustainable investing with the view to giving back more to environmental and local social causes in connection with the opening and operating of mines worldwide.

Responsible investing is an increasingly sophisticated endeavor across the investment world and affects all sectors of the global economy. For the precious metals mining sector, substantial innovation is replacing a historically patchy approach to environmental, social and governance ("ESG") issues. Increased institutional and investor demands have helped shift attitudes and policies toward much stronger ESG policies.

Sprott ESG Policy Statement

Sprott Inc. believes it is part of our corporate responsibility to deliver returns by being a responsible investor. We believe that integrating ESG matters into investment decision-making processes and active ownership practices are key tenets of being a responsible investor.

Sprott ESG Principles

The United Nations Principles for Responsible Investment (“UNPRI”) were launched in 2006 with the aim of ensuring that ESG matters are considered during the investment process and subsequent management of investments. Although the UNPRI framework is voluntary, as a signatory Sprott Inc. has committed to, where consistent with the fiduciary responsibilities of our subsidiaries, incorporating ESG factors into our investment decision making and active ownership practices.

Sprott will endeavor to observe the six UNPRI principles

- Principle 1. We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2. We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3. We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4. We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5. We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6. We will report on our activities and progress toward implementing the Principles.

Sprott Inc. has created an ESG Committee that has been tasked with the creation and ongoing implementation of Sprott’s ESG program in an appropriate manner for our various operating subsidiaries. Furthermore, Sprott Inc. undertakes to use reasonable endeavors to:

- Comply with relevant regulations governing the protection of human rights, occupational health and safety, the environment, and the labor and business practices of the jurisdictions in which we conduct business

- Adhere to the highest standards of conduct intended to avoid even the appearance of negligent, unfair or corrupt business practices

- Regard the implementation of our ESG program as an integral part of how we do business

- Instruct our investment professionals in the identification and management of ESG risks and opportunities

- Recognize that our ESG responsibilities are ongoing and encourage continual improvement in the execution of our ESG program

The ESG Committee will periodically review the effectiveness of Sprott’s ESG program and report relevant findings to the CEO and Board of Sprott Inc.

Contact Us

Telephone: 416.943.4394

Email: gwilliams@sprott.com

Investment Risks and Important Disclosure

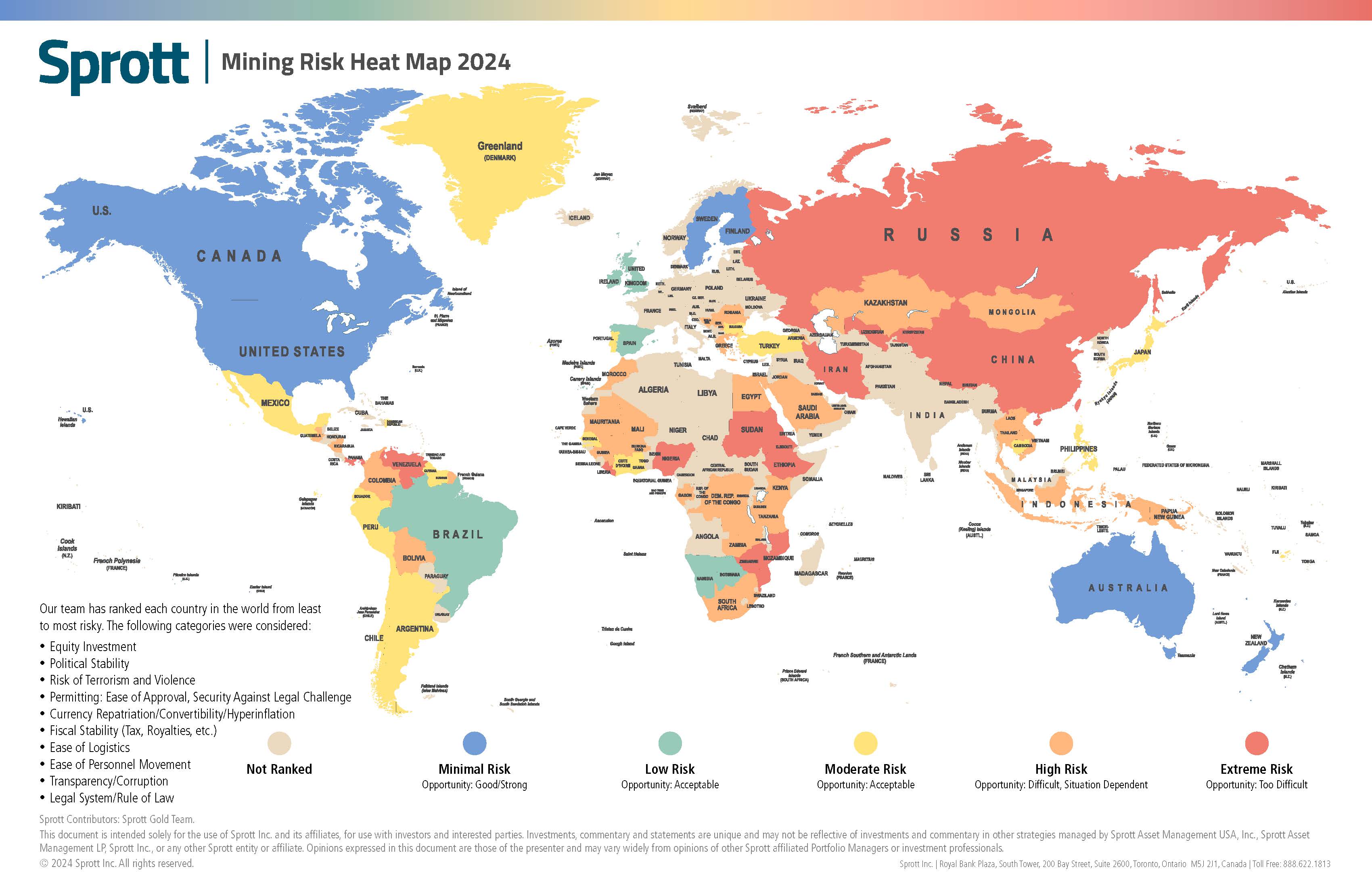

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary, and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.